While things in China are pointing towards bearish Bitcoin price action, and mining in the region is on the slide, there are a few reasons to be bullish on the cryptocurrency side of things. Ethereum, as the second-largest cryptocurrency by market cap is seeing such increased action that it has even overtaken Bitcoin.

Despite this, the backdrop for Bitcoin remains bullish as news in the west paints a good picture for the cryptocurrency. German law allowing around $415 billion investment into cryptocurrency comes into effect. In the US more financial institutions are getting involved with offering crypto to their customers, a step which can bring about mass adoption on a larger scale.

Apart from the cryptocurrency space, there is good news in traditional stocks as they continue to show bullish movements and perform better than expected. The Non-farm Payrolls (NFP) number released on Friday gives further evidence of a recovering jobs market which has bolstered the stock market numbers.

Stocks continued their bullish trajectory as a better-than-expected Non-farm Payrolls (NFP) number released on Friday gives further evidence of a recovering jobs market. The US economy added 850,000 jobs last month against a consensus of 706,000 in a blowout beating of expectations which brought much cheer to the markets.

The S&P continued its 7-straight day of advance, rising 1.7%. The Dow rose 1%, while tech-heavy Nasdaq continued its stair-stepping increase, closing the week up 2% at 14,715. The S&P has now risen in five of the past six weeks, while the Nasdaq has gained in six of the past seven weeks. Tech and healthcare stocks were the major winners, leading the indices to record levels to close the week ahead of a long weekend that sees Monday as a US Independence Day holiday.

The market seems to think that the jobs report is not strong enough to warrant an earlier interest rate move by the FED, as manifested by a calm bond market which saw bond yields dipping slightly. The 10-year Treasury bond yield remained steady at 1.43% on Friday, seemingly unaffected by the stronger than expected jobs number.

The USD as a result saw a bit of profit-taking after rising continuously since the FED’s hawkish surprise. However, dips in the USD remain bid as early Asian trading on Monday saw some USD buying, with USD the main gainer against all other currencies. The DXY is currently at around 92.40, still looking bullish.

Gold and Silver managed to gain some ground, with Silver leading the way with a 4% gain for the week, opening above $26.50 in early Asia trading on Monday. Gold gained 2% for the week to $1,788.

Crude Oil gained 6% by the end of last week after a surprise stalemate in last week’s OPEC+ meeting to talk about upcoming supply output. However, with talks set to resume this week and having price come near a major resistance at $76, some profit-taking is underway as we begin the new week, with Crude down 0.3% at $74.60.

Expect a quieter start to the week as the US markets will be closed on Monday for the Independence Day holiday. Traders may also be waiting for FED meeting minutes to be published on Wednesday to get a clearer picture of USD policy before making big bets in the market.

BTC Macro Backdrop Continues To Be Bullish

With July finally here, the German law allowing around $415 billion investment into cryptocurrency comes into effect. The law, first announced in April, allows “special funds” to invest up to 20% of their $1.8 trillion assets under management into crypto with effect from July 1st 2021. As we are still early days into July, the impact of this law is not seen as yet, even though this is very welcoming news for the cryptocurrency sector.

Over in the USA, more financial institutions are getting involved with offering crypto to their customers, a step which can bring about mass adoption on a larger scale. Some 650 banks and credit unions in the USA, through payment giant NCR, will be ready to offer BTC purchases to an estimated 24 million customers soon.

The crypto will be held in custody by NYDIG for the bank customers to make it hassle-free for them. Meanwhile, US senator Cynthia Lummis was featured in a media interview in which she said she owned BTC and recommended others follow suit to “buy and hold” BTC as a way to save for their future.

Meanwhile, in another push from banks, Morgan Stanley reveals that it bought 28,289 shares of GBTC in a show of increasing institutional FOMO from banks.

Another two institutional investors also announced their involvement with cryptocurrencies, although their involvement was not met with much enthusiasm.

Point72 of Steve Cohen and Soros Funds of infamous trader, George Soros, who broke the British Pound in 1992, also said they were entering the trading of cryptocurrencies, much to the unease of native crypto investors who are afraid that Soros may increase downside volatility for BTC and the other cryptocurrencies.

This wasn’t very welcoming news in a stressful week that saw BTC network activity suffering due to China’s crackdown on miners that continues to send miners unplugging to move their mining facilities elsewhere.

BTC Miners Migration Out of China Sends Network Activity Plummeting

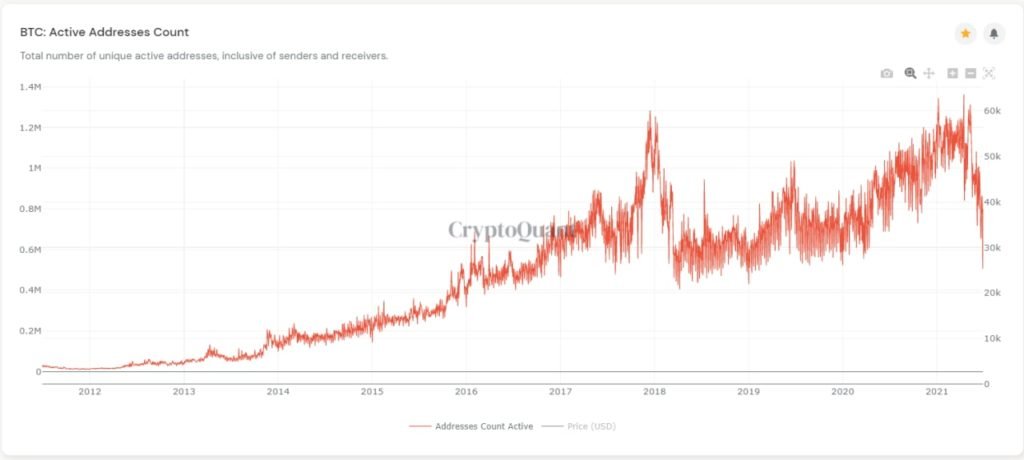

Activity on the BTC blockchain has been adversely affected due to the unplugging of miners from China, causing a huge fall in unique address activity on the BTC blockchain as more and more miners get unplugged and are in transition.

As a result, as more miners in other provinces of China also get the notice to leave, the hashrate of BTC has seen around a 50% fall since its peak. This is by far the largest drop in hashrate in BTC’s history and inadvertently also created BTC’s worst Q2 performance in 8 years as June came to a close.

Even though things aren’t looking very good now, the migration-induced fall in unique address activity and the corresponding drop in hashrate situation is temporary and things will be back to normal once the great migration of miners is done in a few months.

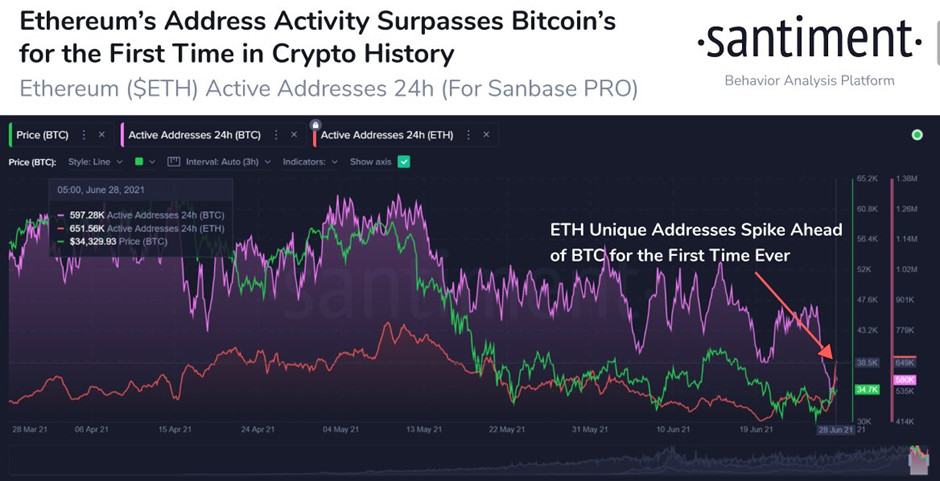

The Big BTC Hashrate Migration Gives ETH a Chance To Leapfrog

However, this fall in hash rate and activity on the BTC blockchain has given ETH a chance to surpass BTC in terms of activity. For the first time in history last week, ETH address activity was above BTC address activity, as prices have soared back above $2,300 after ETH witnessed a worse selloff than any other large-cap crypto. The second-largest blockchain is seeing a spike in activity ahead of the highly anticipated EIP-1559 update on mainnet, which is expected to be rolled out in the coming weeks. This may provide a lift for ETH to outperform BTC in the near term until the great mining migration is complete for BTC.

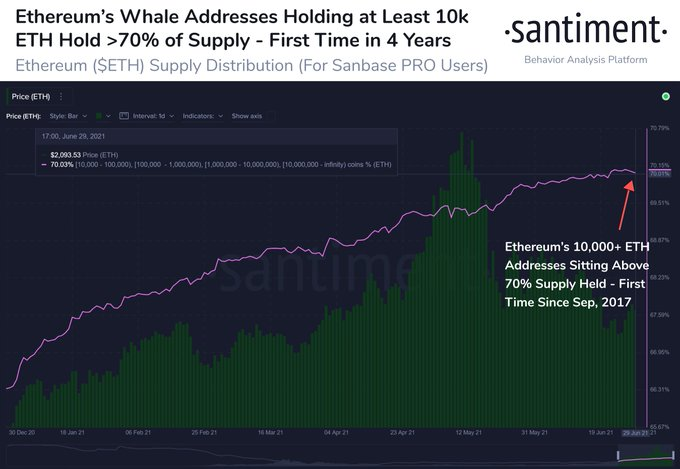

With investor confidence in ETH soaring ahead of its upgrade, supply of ETH on exchanges is witnessing a sharp drop, falling to its lowest level since November 2018. This shows that dip buyers have been buying and removing ETH from exchanges, reducing the supply available for sale, which is a positive for price.

Data also further evidenced that much of the supply of ETH has been bought by whales holding more than 10,000 ETH. For the first time in four years, these whales collectively hold more than 70% of the supply of ETH in the market.

GBTC Unlock Poses Short-term Headwinds for BTC

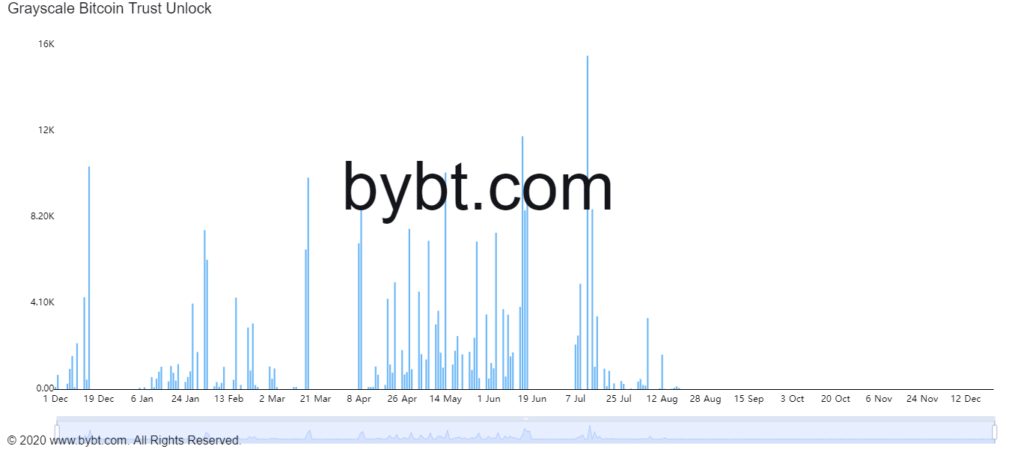

As negative news surrounds BTC in the short-term, response from institutional investors appear to be cautious ahead of the unlocking of the largest amount of GBTC shares. 18,000 GBTC shares will be unlocked come July 18, which some experts are warning may dampen the demand for BTC from smart investors from now after the event to see if the unlocking will pose any selling pressure on BTC price.

Any selling pressure, however, is expected to be short-lived as many high-profile investors like Robert Kiyosaki of bestselling personal finance book, Rich Dad Poor Dad, are revealing that they are on the sidelines waiting for a BTC dip to buy. Jack Dorsey’s “The B Word” event to encourage institutional purchase of BTC also happens to be scheduled that very week on July 21, which could incite large investors to mop up whatever Grayscale may sell. It will be interesting to see what happens to BTC price if Grayscale does not dispose of any BTC during that unlocking though.

Based on the unlocking schedule below, the last batch of unlocking for the year will be complete by mid-August, which means no more GBTC induced selling pressure for the rest of the year.

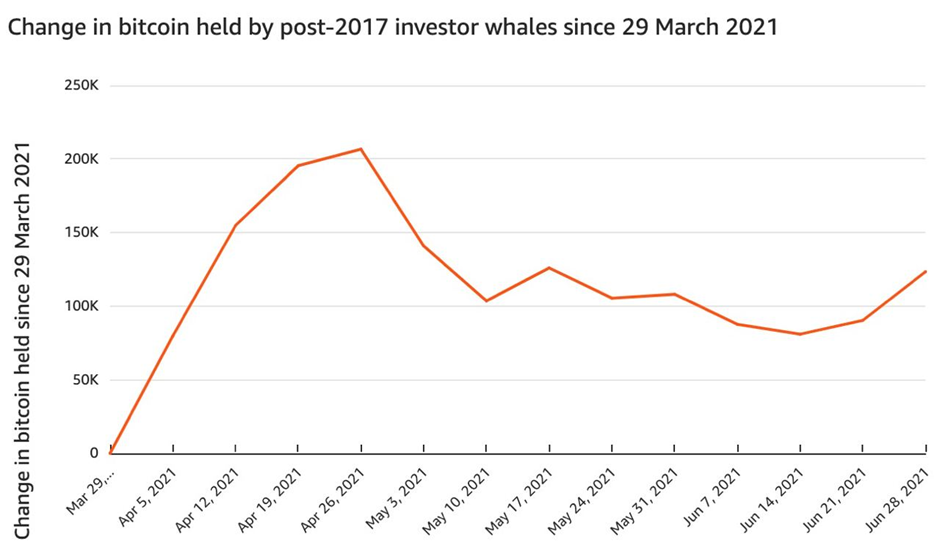

A look at metrics tracking the whale activity of wallets holding more than 100 BTC who sold during the April price peak when BTC was trading above $60,000 suggests a slow accumulation since mid-June. These whales are left with around 84,000 BTC to acquire to be back to the same number of BTC they had before they sold in April. Could these whales be waiting to pounce during the GBTC unlock to try and buy at a better price as well? Or are they taking their time to accumulate since the great BTC hashrate migration will take a while to recover?

Historically Accurate Metric Signals BUY on BTC

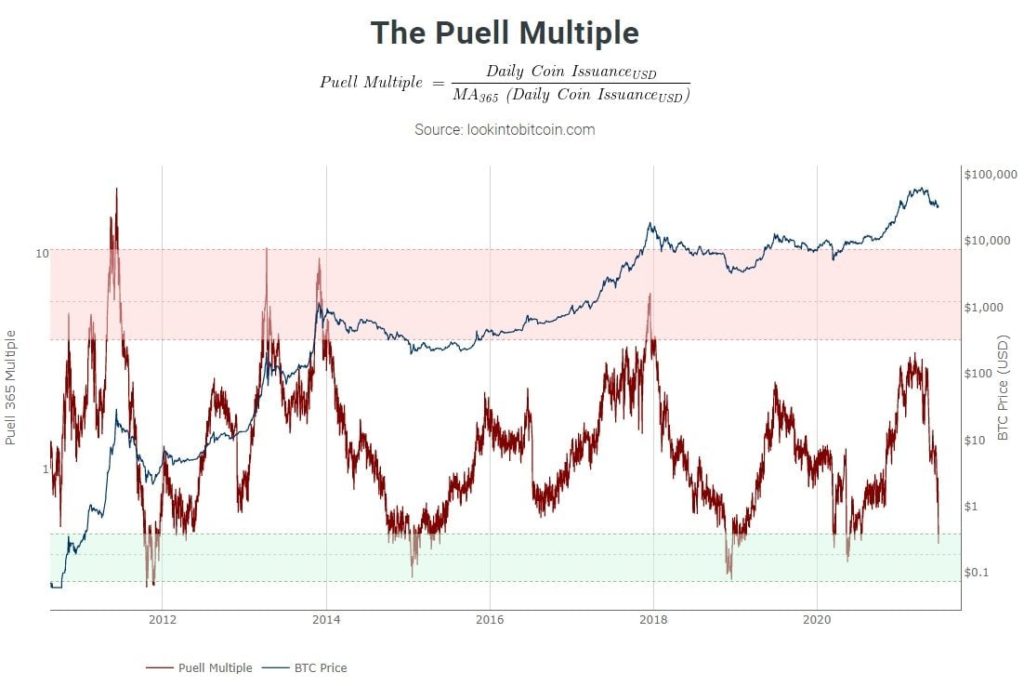

Even though mining metrics are not looking fantastic for BTC in the short-term due to the great hashrate migration, a historically accurate metric is showing a BUY signal for BTC. In the below diagram, every time the Puell Multiple moves into the green zone is preceded by a rally in the price of BTC shortly after. The multiple has moved into the green zone again, giving out a Buy signal.

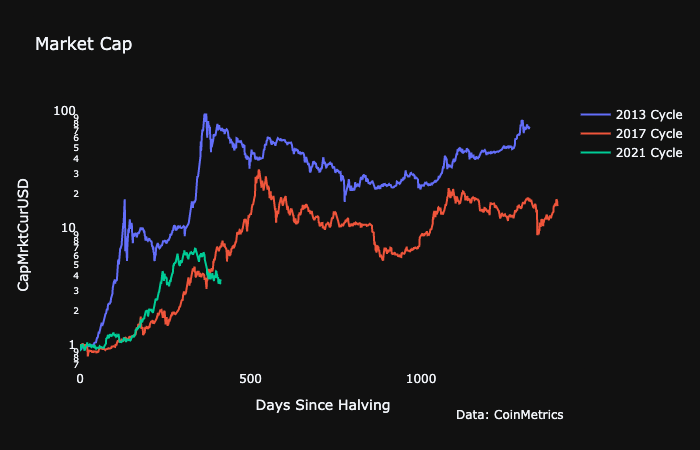

Other measures also point to a bull run not looking to end as data plotted by an analytics firm shows this year’s bull run against the previous two bull runs. In the 2013 bull market, the bull cycle peaked 370 days after the first halving, and in 2017 the bull market lasted 524 days after halving. So far this year, the days since halving have been 413 days. Could this imply that we have not yet seen the peak of this bull cycle then?

With BTC supply held at exchanges also hitting a low point last seen in early Jan, perhaps the time for BTC and the broad crypto market to rebound could be just within a couple of weeks.

About Kim Chua, Noble Pro Trades Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.