At the start of April, Noble Pro Trades, in partnership with Europe-based financial software provider Covesting, launched the highly anticipated Covesting Fund Management Module beta.

The tool connects traders in such a way that both benefit from one another, profiting from each other’s activity on the platform.

Using the Covesting Fund Management Module beta, traders from around the world can become fund managers, and market themselves, their strategies, and even their win rates to the trading community at large.

Investors can inject their own capital into these funds, profiting from the positions taken by the professional trader, earning the investors a return on investment without ever having to make a trade of their own. However, it is important to note that historical performance is never a guarantee for future successful results. Volatility combined with leverage can lead to both substantial profits as well as complete capital loss, so investors must never invest more money then they can comfortably afford to lose.

And while these fund managers do earn a revenue share from any success fees generated by the investor’s capital, it is investors who truly benefit by making the most successful traders across the globe work for them thanks to Covesting Fund Management Module.

Performance Improvement: Separating Personal Accounts From Fund Accounts

On April 24, Noble Pro Trades released an improvement update platform’s infrastructure, separating Personal trading accounts from Fund Management trading accounts.

This enables every Noble Pro Trades platform user to be able to create a fund and manage it through a dedicated trading terminal, while keeping the personal trading terminal separate, complete with all the incentives, bonus schemes, and fee discounts, while remaining under the same account.

Previously, this required two separate accounts to be created and maintained. This inconvenience has now been removed.

We have provided early access to the Covesting Fund Management Module beta to only very few Noble Pro Trades platform users in order to detect and fix any issues, and make any structural changes or internal improvements that could impact stats ahead of a full release.

Gradually, as we make improvements and further stabilize performance, additional users will be provided with access.

Noble Pro Trades and Covesting thank all who have participated in the beta thus far. Your assistance in eliminating any potential bugs or performance degradation prior to scaling and marketing the module to the masses, is greatly appreciated.

Early Access Traders Battle For Supremacy on Noble Pro Trades

It is clear that fund managers have plenty to gain by making a name for themselves, earning a portion of the profits from each trade made with investor’s money.

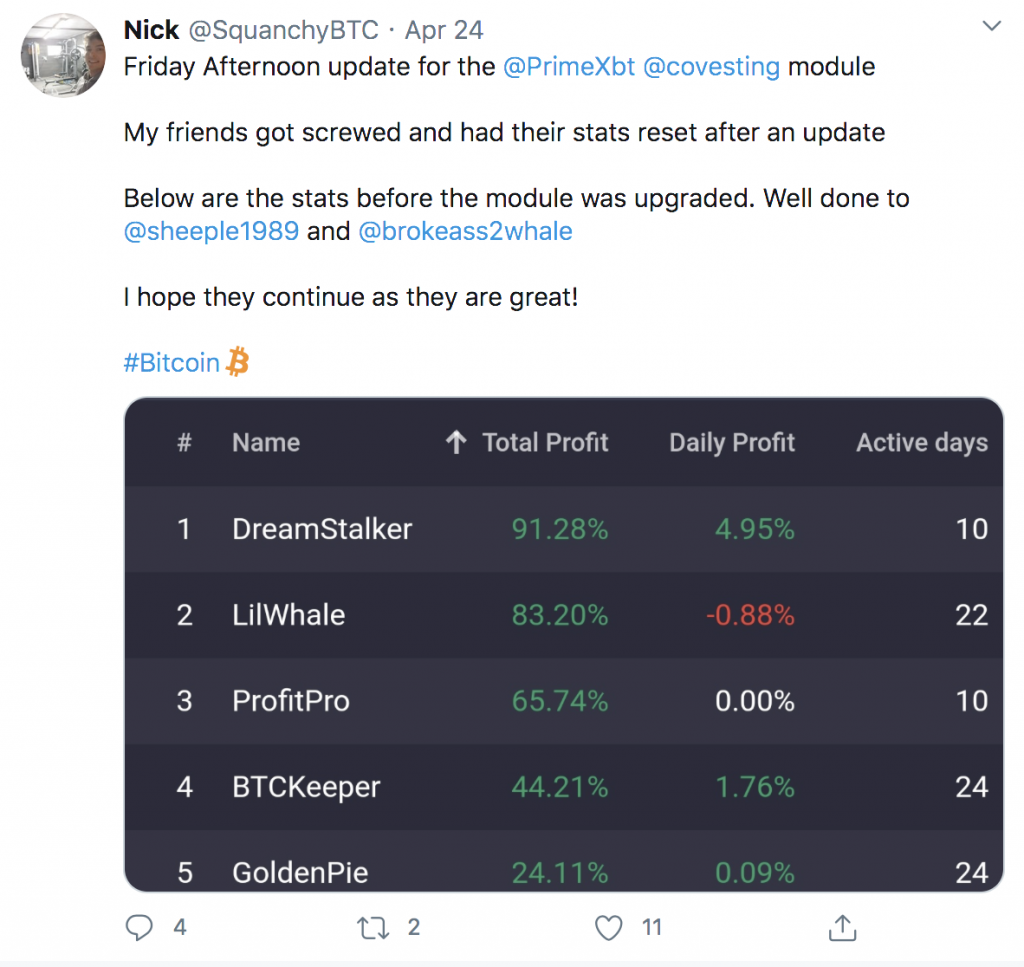

Each day, the ranks of these top traders changes in real-time within the Rating section of the Covesting Fund Management Module.

Unfortunately, the recent upgrade required all traders to re-create all the funds from scratch.

An inspiring tweet from a Noble Pro Trades client encouraged Covesting users to take the clean slate as an opportunity to prove their track record of success once again.

The comment on Twitter not only shows how the fierce competition on the platform is eager to maintain their rankings, but it also shows that traders everywhere are taking note, and following those with early access to the Covesting Fund Management Module on social media, potentially to see who they may invest in when the full release rolls out.

This list will only expand and grow as traders are provided with access to the module and more top traders around the world catch wind about the tool through word of mouth.

The platform picking up traction so quickly and competition already heating up, is a positive sign for the future of the Covesting Fund Management Module, which will eventually attract the world’s best traders and fund managers.

Working Towards the Full Launch of the Covesting Module

In cooperation with Covesting, the Noble Pro Trades team continues to improve features, perform Q&A testing, and work to stabilize performance. Currently, the beta is limited only to creating a Fund, managing positions and other features related to the Fund ecosystem.

Once the full platform is launched, the Investing feature will also go live, and then users will be able to invest capital into one or several of the Funds on the Covesting Fund Management Module. Investors can start paying close attention now to the strategies these top traders use, then later use the information to select the best performing funds.

Stop stressing night and day over which positions to take, or spending hours performing technical analysis – let others do it for you, with the Covesting Fund Management Module. Once again, even though the platform provides great transparency to all users – it cannot guarantee even the highest-ranked fund manager can’t have a bad day, week, or month, and suffer losses that lower their ranking and win rates.

The Covesting Fund Management Module beta is available exclusively here at Noble Pro Trades.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.